Let’s start with the basics. Value-added tax (or VAT) is an indirect tax added to a product’s sales price. It represents a tax on the value added to goods or services throughout their production process.

VAT has been a standard source of revenue for governments around the world, in European countries like England, France, and Germany, as well as in Canada, Australia, and many others. Now, for the first time, companies in the GCC will have to collect VAT.

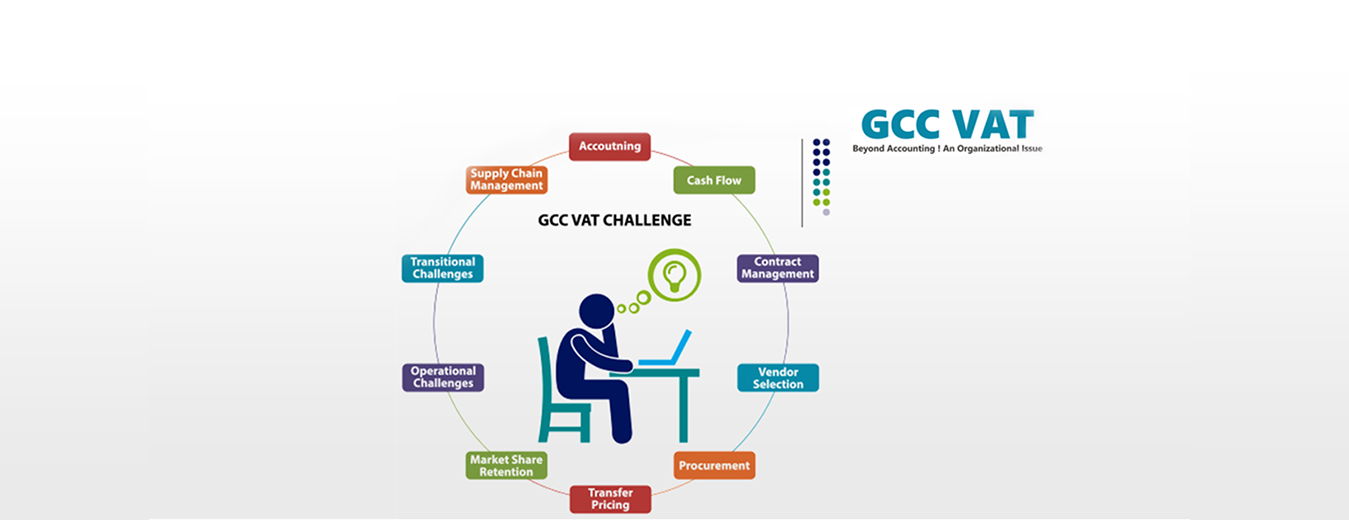

VAT is levied at nearly every stage of the supply chain, from raw materials to the final product sold in stores. Ultimately, consumers end up paying the tax—but businesses are still responsible for collecting it, submitting it to the government, and reporting on how much they collected; along with how much they deducted for their own costs. With that in mind, it’s important to make provision and plan ahead to efficiently integrate this change into your organization’s processes and culture

The vast majority of GCC companies will need to ensure they efficiently and accurately determine and report on VAT requirements by automating these new processes. Businesses that meet a minimum annual turnover will have to register for VAT. But small organizations that turn over less than the minimum requirement won’t need to register. Businesses that distribute goods and services in certain industries, such as healthcare and education, will not need to comply with VAT regulations.